Understanding Whole Life Insurance Premium Components for Infinite Banking

When exploring whole life insurance as a financial strategy, particularly for the Infinite Banking Concept (IBC), understanding the premium structure is essential. Unlike term life insurance with its straightforward premium model, a whole life policy can have several distinct components that work together to create both protection and cash value growth.

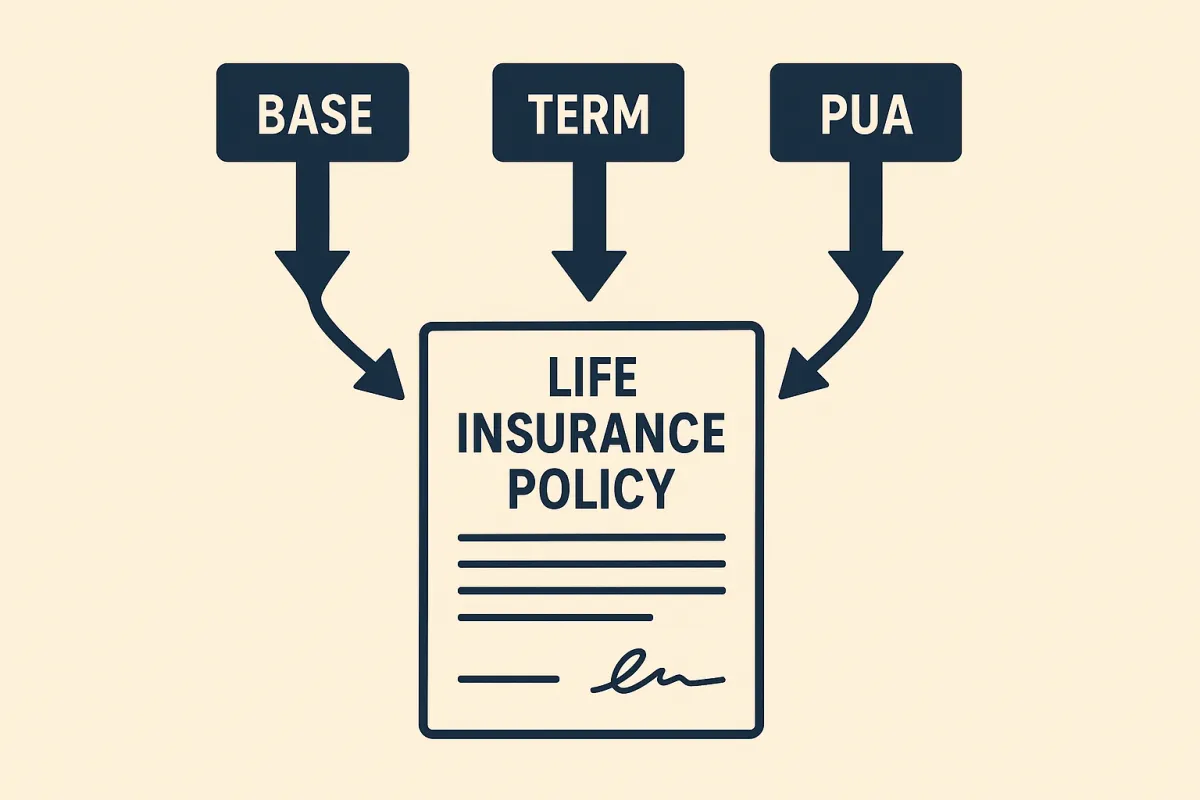

In this article, we'll break down the three key elements that make up a whole life insurance premium designed for Infinite Banking: the base premium, term rider, and Paid-Up Additions (PUA).

The Foundation: Base Premium

The base premium forms the backbone of any whole life insurance policy. In fact traditional whole life insurance would be considered 100% base premium. This fundamental component:

Purchases the guaranteed death benefit that lasts your entire lifetime

Remains fixed and guaranteed never to increase from the day your policy begins

Contributes to predictable, guaranteed cash value growth over time

Is the core component for calculating annual (non-guaranteed) dividends

Functions similar to principal payments on a mortgage, steadily building equity in your death benefit

Even without additional riders, a traditional whole life policy with just the base premium will accumulate cash value over time. Cash value represents the present value of your future guaranteed death benefit.

As your policy matures, the base premium becomes increasingly significant in generating cash value and dividends.

Boosting Death Benefit: Term Rider

The term rider is an optional yet strategic component in an IBC-designed policy. Unlike a separate term life insurance policy, this rider integrates term insurance directly into your whole life contract.

When included in your premium structure, a term rider:

Significantly increases your initial death benefit at a lower premium price compared to purchasing the same amount of whole life insurance

The increased death benefit helps maintain compliance with IRS Modified Endowment Contract (MEC) limits

Creates "room" for more PUA premium which helps build more cash value early on

Term is a true cost that can affect the cash value growth over the long-term

Some insurance carriers offer blended term-PUA riders, where failing to pay the PUA portion (or sometimes even if you do) can affect coverage of the term rider costs, potentially leading to rising expenses over time.

Accelerating Growth: Paid-Up Additions (PUA)

The Paid-Up Additions (PUA) rider stands as perhaps the most crucial component for policies designed specifically for the Infinite Banking Concept. This powerful rider:

Allows you to purchase additional fully paid-up life insurance with each premium payment

Requires no future premium payments for the additional death benefit once purchased ("paid-up")

Because no future premiums are due on the death benefit created, PUA serves as the primary driver of accelerated cash value growth, particularly in early policy years

Provides premium flexibility, as PUA contributions are not required to keep the policy in force

Enhances potential future dividends, as dividends are calculated based on the amount of permanent death benefit

By allocating premium toward PUAs, policyholders effectively increase their "equity" in the death benefit faster, creating more accessible cash value earlier on.

Balancing Components for Optimal IBC Design

The specific allocation between base premium, term rider, and PUA rider can be carefully tailored to individual interest when implementing the Infinite Banking Concept. A well-designed policy balances these components to:

Maximize early cash value growth without impeding policy growth in later years

Provide appropriate death benefit protection

Maintain premium flexibility

Comply with IRS regulations like the MEC limits

It's important to note that everything having to do with all types of insurance are nothing more than tradeoffs between cost and risk.

Therefore, understanding the tradeoffs of how these premium components work together is essential for anyone considering whole life insurance as part of their financial strategy, especially those interested in implementing the Infinite Banking Concept.

At StackedLife, it's our job to show you what the various tradeoffs to different policy designs are, so that you can decide on which tradeoffs are best for you.